By Jessica Naziri, CNBC.com

What goals have you reached in the last year? Where are you still behind? In challenging economic times, people look for different ways to save money and clean up their finances. While the biggest savings come from limiting your spending to the cash in your wallet, the trick is to set reasonable goals. A good approach is to start with a few things that are so easy to fix that you'll stick with the program. You may be surprised how quickly these small changes can add up to real money in your pocket.

Here are 10 simple resolutions that can improve your financial position in the months and years to come.

See the slideshow: 10 Money-Saving Strategies

Shop Insurance

The reason you have to shop every year is that home and auto insurers change their prices based on their claims experience. The insurer who was the best bet two years ago may not be such a good value now. Spend half an hour determining whether you can get a better deal, and you might save yourself hundreds of dollars. Having the same carrier for home and auto insurance may result in a package discount of up to 15 percent. If your annual auto insurance premium is several thousand dollars, this could really pay off. Many companies also offer a "future effective discount." If you pay today for your policy to start next month, you may save even more money.

Adjust Your Withholding

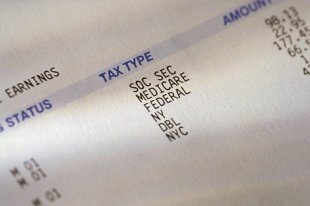

Most Americans pay the bulk of their annual tax bills via payroll withholding. Through this process, a percentage of your pay is taken out each pay period and sent to the IRS, where it is credited toward your final tax bill. In 2011, the average tax refund was over $3,000, according to the IRS. That's $250 a month! That means you've given Uncle Sam free use of your tax money - without receiving any interest. The best course, tax experts say, is to adjust your withholding exemptions so your tax payments will match your actual tax liability.

Pay Cash

Make Habit a Treat

Boost Your 401k

For most taxpayers, investing in a 401(k) is the best way to lower your taxes and build a retirement nest egg. If you're among the 51 million Americans who participate in a company's 401(k) plan, you can contribute up to $17,000 in 2012, up $500 from 2011. If you are 50 or older, you can stash an extra $5,500 in catch-up contributions for a total of $22,000.

If you pay 30 percent of your income in federal and state taxes, each $100 contributed to your 401(k) costs you just $70. If your company matches your contributions at a rate of, say 50 cents on the dollar, you end up with $150 in savings for something that cost you only $70. If you are self-employed, you can stash even more into a solo 401(k) plan and a tax-deferred retirement account because you contribute as both an employee and an employer.

Roth IRAs are a great option for anyone interested in tax-free retirement income, and are particularly good for young workers who could benefit from decades of tax-free growth. Roth IRAs are also good for anyone who expects to be in a higher tax bracket in retirement.

Make Savings Automatic

Take Care of Yourself

While this may sound more like good physical than fiscal advice, an increasing number of company health plans are paying you to take care of yourself. If you quit smoking or promise to exercise at least once or twice a week, they're likely to give you a break of $50 to $500, depending on your company health plan.

Raise Your Deductible

Use CFL Lightbulbs

Buy in Bulk

When it comes to buying in bulk, savings can be hit or miss. But research has shown that consumers who make a midweek "fill in" trip to the store buy twice the number of items they had intended. Some nonperishable items you should buy in bulk include toilet paper, alcohol and vitamins.

Toilet paper: Buying in bulk can be up to 50 percent cheaper than buying just a few rolls at a time. So find a place to store some extra (try under your bed if you run out of space in the bathroom) and save yourself a few bucks.

Alcohol: Would you rather pay $8 for a six-pack or $14 for 20-pack? Go with the 20-pack and you'll not only save money on beer, but you'll also save on gas because you will be making fewer trips to the store.

Vitamins: You can save about $1 per bottle by buying in bulk, but be wary of expiration dates.

More from CNBC:

Least Expensive Cities

Easy High-Paying Jobs

Celebrity Insured Body Parts

No comments:

Post a Comment